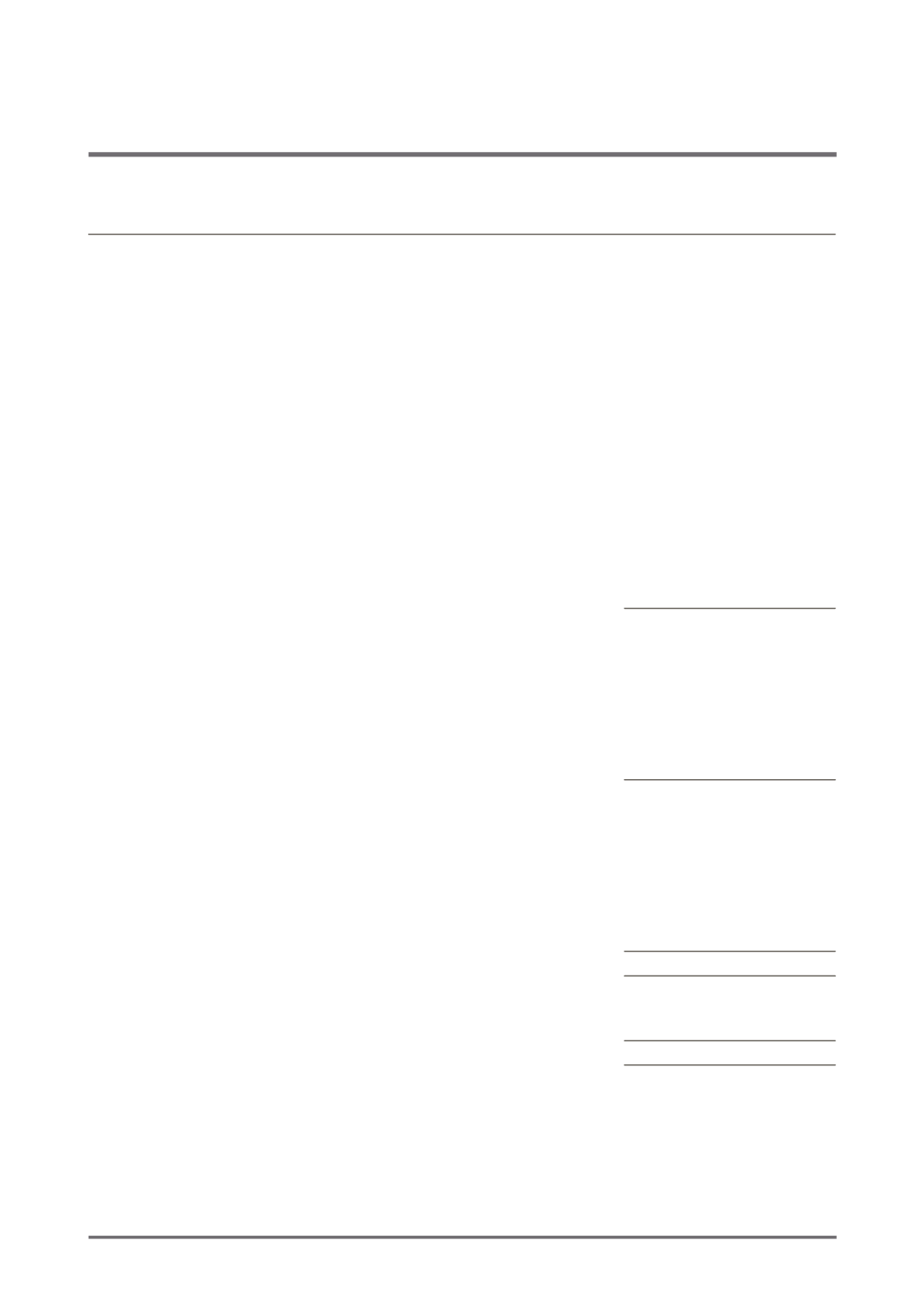

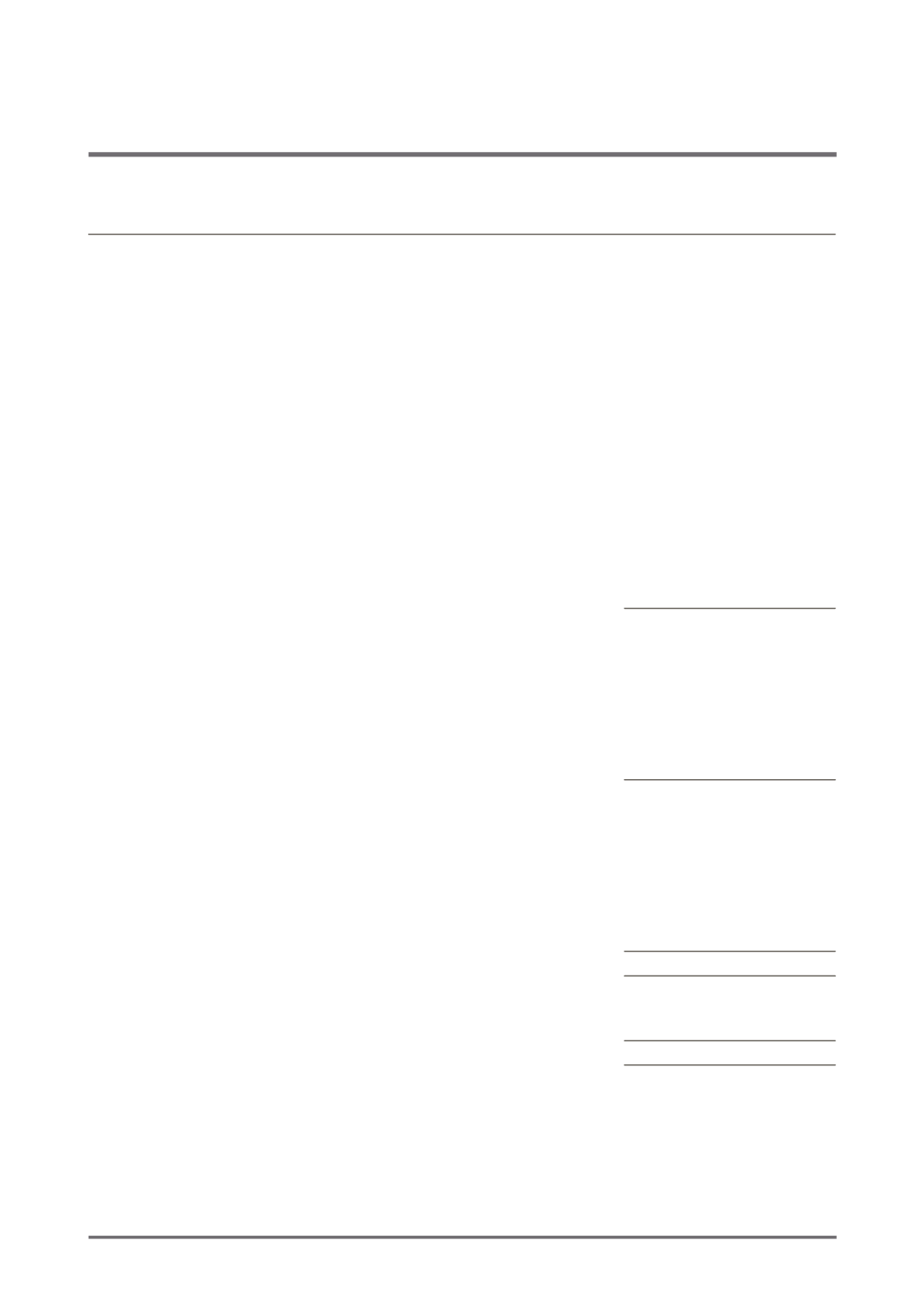

Consolidated Statement of Cash Flows

Year ended 31 December 2014

The accompanying notes form an integral part of these financial statements.

TIH Limited

22

TIH Limited

Note

2014

2013

$’000

$’000

Restated

Cash flows from operating activities

Profit for the year

591

42,717

Adjustments for:

Income tax expense

–

4,529

Interest income from deposits

(111)

(106)

Interest income from unquoted equity investments

(2,245)

(2,152)

Dividends/distributions from subsidiaries

(179)

(7,675)

Dividends/distributions from equity investments

–

(64)

Depreciation on property, plant and equipment

23

–

Interest expense on financial liabilities measured at amortised cost

81

–

Consideration for termination of the Management Agreement

–

13,750

Net change in fair value of investments at fair value through

profit or loss

(2,679)

(4,460)

Net change in fair value of derivative financial instruments

373

–

(4,146)

46,539

Changes in operating assets and liabilities

Investments

(29,049)

73

Loan receivable

–

1,338

Other receivables

15,521

(49)

Other payables

(12,758)

169

Provisions

(487)

–

Cash (used in)/from operations

(30,919)

48,070

Dividends/distributions from subsidiaries

179

7,675

Dividends/distributions received from equity investments

61

70

Net interest received

110

787

Performance incentive fees paid

–

(4,925)

Performance incentive fees refunded

–

1,440

Income tax paid

–

(4,723)

Net cash (used in)/from operating activities

(30,569)

48,394

Cash flows from investing activities

Purchase of property, plant and equipment

(102)

–

Net cash used in investing activities

(102)

–