This printed article is located at https://tih.listedcompany.com/financials.html

Financials

Condensed Interim Financial Statements and Dividend Announcement for the six months ended 30 June 2025

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

Condensed Interim Financial Statements and Dividend Announcement for the six months ended 30 June 2024

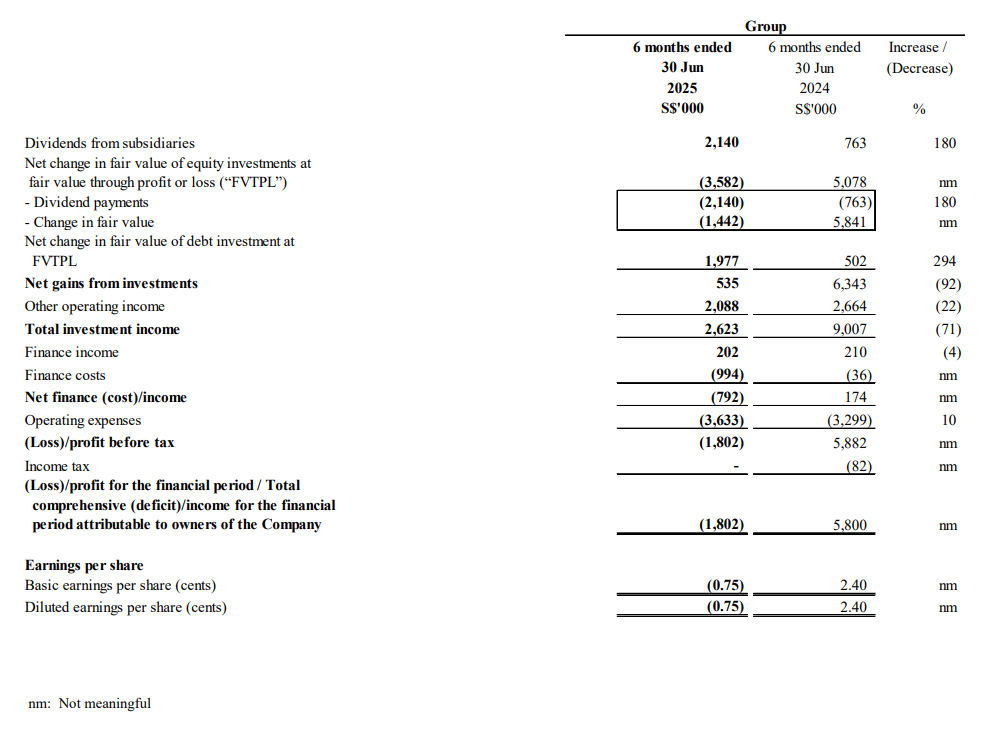

Condensed interim consolidated statement of profit or loss and other comprehensive income

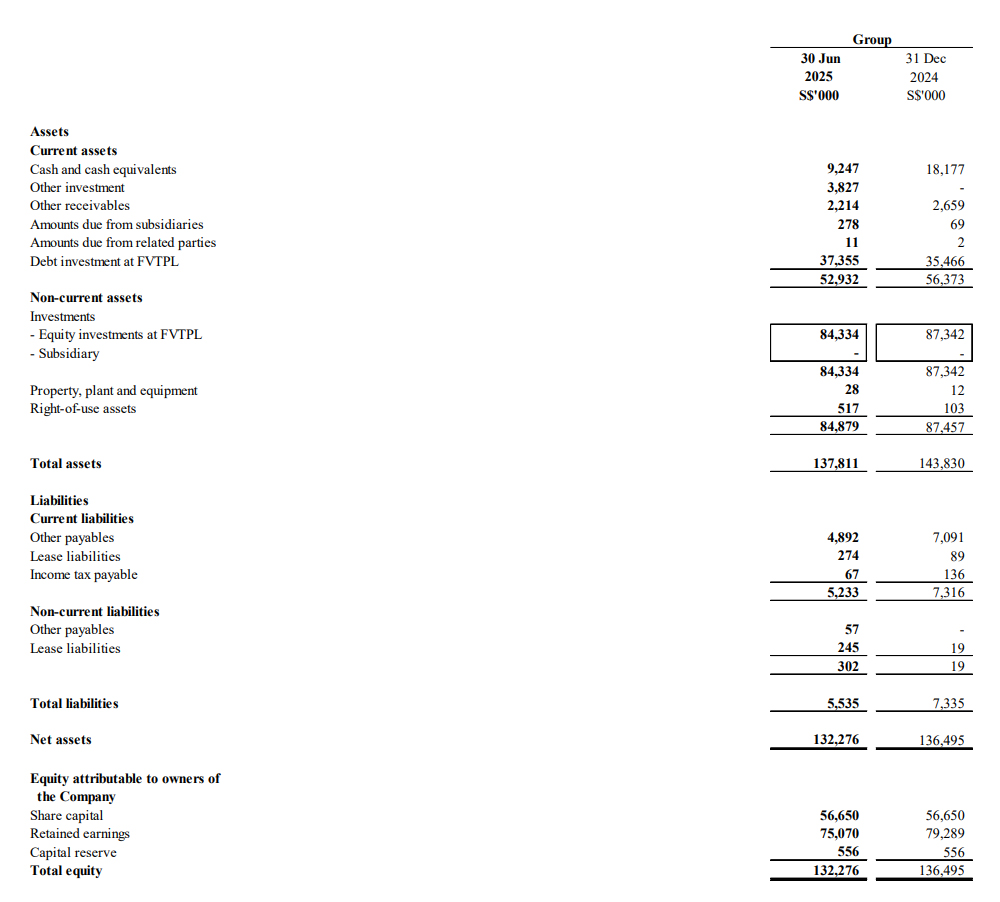

Condensed interim statements of financial position

Group Financial Performance

The Group’s income is primarily derived from the realisation and/or revaluation of its investments and fee income.

For the six months ended 30 June 2025 (1H2025), the Group reported total comprehensive deficit of S$1.8 million mainly attributed to:

(i) Fair value loss on equity investments at FVTPL of S$1.44 million; and

(ii) Operating expenses of S$3.63 million.

The losses were offset partially by:

(iii) Other operating income of S$2.09 million; and

(iv) Fair value gain on debt investment at FVTPL of S$1.98 million.

Net Asset Value ("NAV")

The Group’s NAV as at 30 June 2025 was S$132.28 million (representing a NAV of S$0.55 per share), a decrease of S$4.22 million from the NAV of S$136.5 million (S$0.56 per share) as at 31 December 2024.

The decrease in the Group’s NAV of S$4.22 million was primarily attributed to a fair value loss of S$1.44 million on equity investments at FVTPL, dividend payment of S$2.42 million for the financial year ended 31 December 2024 and net operating expenses of S$1.54 million. The decrease was partially offset by a fair value gain of S$1.98 million on debt investment at FVTPL.

Commentary

Private equity in 2025 continues to reflect the global shift towards caution and recalibration. Private equity activity in Southeast Asia started on a strong note , driven by efforts to deploy accumulated dry powder and capitalise on deal momentum carried from the previous year. However, the private equity market faced headwinds with tariff volatility, prolonged regulatory and clearance processes, and broader geopolitical tensions. Southeast Asia remains resilient, supported by growing private consumption, favourable demographics, and growing interest in sectors such as healthcare and digital infrastructure.

Amid cautious capital deployment, liquidity pressures and prolonged holding periods, fund managers are focusing on operational improvements and liquidity planning, with less reliance on macroeconomic tailwinds. At the same time, global trade policies are prompting renewed capital flows into Southeast Asia, fueling cautious optimism amid supply chain shifts. While deal activity moderated in Q2 2025, broader outlook remains positive, supported by an expanding pool of buyers across the region and early signs of stabilisation in the exit environment.

Against this backdrop, TIH remains disciplined and selective in deploying capital, anchored by a long-term investment horizon and strong regional network. The Group continues to seek out strategic investment opportunities across Southeast Asia and Greater China, leveraging its partnerships and capabilities in turnarounds, M&As, and restructuring to deliver value. Strategies involving special situations and the acquisition of non-core assets continue to be explored to unlock value.

TIH’s Investment Business segment is supported by a strong track record in restructuring, M&A and strategic transactions, while the Fund Management segment, operated through TIH Investment Management Pte. Ltd. (“TIHIM”), continues to scale recurring fee income and build a robust platform of third-party funds across credit, public equity and alternative strategies. With a Capital Markets Services License from the Monetary Authority of Singapore (MAS), TIH IM has established a strong track record of managing third party investment funds.