This printed article is located at https://tih.listedcompany.com/corporate_governance.html

Corporate Governance

The Board and Investment Manager of TIH Limited ("Company" or "TIH", and together with its subsidiaries, "Group" or "TIH Group") are committed to maintaining a high standard of corporate governance and believe that commitment to good corporate governance is essential to the Company’s business and performance.

The following describes the Company’s corporate governance practices that were in place during the financial year ended 31 December 2024 ("FY2024") with specific references to the principles and provisions set out in the Code of Corporate Governance 2018 ("Code"). As a company listed on the Singapore Exchange Securities Trading Limited ("SGX-ST" or "Exchange"), the Board of Directors is pleased to confirm that the Company has generally adhered to the principles and provisions of the Code as well as the Mainboard Listing Manual of the SGX-ST ("Listing Manual"), where appropriate and applicable and any deviations from the Code have been explained in this Statement.

The Board's Conduct of Affairs

Principle 1: The Company is headed by an effective Board which is collectively responsible and works with Management for the long-term success of the Company.

Roles of the Board

The Board which comprises 2 Deemed Executive Directors, 4 Independent Directors and 1 Non-Executive Director, acts in the best interest of the shareholders of the Company ("Shareholders") by overseeing the Company's governance, providing direction and guidance to its investment manager and holding the investment manager accountable for performance. Since 1 September 2014, the Company has appointed TIH Investment Management Pte. Ltd. ("Investment Manager" or "TIHIM"), its wholly owned subsidiary, to serve as its investment manager. The Investment Manager manages the day to day business and administration of the Company pursuant to an investment management agreement.

The Board sets an appropriate tone-from-the-top and promotes the desired organisational culture, ensuring proper accountability within TIHIM. The Company has various policies in place, such as Board Diversity Policy, Whistleblowing Policy, Investor Relations Policy, Dividend Policy and Securities Dealing Policy, which will be discussed in later parts of this Statement. In addition, the Investment Manager has implemented written policies/ code of conduct and ethics within the Internal Control and Compliance Manual ("ICCM"), which encompasses the Securities Dealing Policy, Currency Management Policy, Whistleblowing Policy, Anti-Money Laundering & Counter-Financing of Terrorism ("AML") Policy, Foreign Account Tax Compliance Act ("FATCA") Policy, Personal Data Protection Act ("PDPA") Policy and etc. All staff of the Investment Manager are required to adhere to these policies.

Each Director understands the Company's business and their directorship duties (including their roles as executive, non-executive, and independent directors), acting objectively as fiduciaries in the best interests of the Company. Each Director is required to promptly disclose any confl ict or potential confl ict of interest, whether direct or indirect, in relation to any transaction or proposed transaction with TIH Group as soon as practicable after the relevant facts have come to his/her knowledge. Where a Director has a confl ict or potential confl ict of interest in relation to such transaction, they should recuse themselves from discussions and decisions on the matter, unless the Board is of the opinion that their presence and participation are necessary to enhance the efficacy of such discussion. Nonetheless, the Director shall abstain from voting in relation to the confl ict related matters. The Company's Constitution provides that a Director's interest in the Company's contract, arrangement or proposed contract or arrangement, shall be declared to the Company and a Director shall not vote on any such contract or arrangement in which he/she has direct or indirect personal material interests. A Director shall not be counted in the quorum at a meeting in relation to any resolution on which he/she is debarred from voting.

The primary role of the Board includes the following:

- Providing leadership, overseeing and formulating long-term business strategies, corporate policies and guidelines taking into consideration sustainability issues including environmental, social and governance factors that are material to the Company's business;

- Identifying the principal risks of the Company and establishing a framework of prudent and effective controls which enables risks to be assessed and managed;

- Monitoring and reviewing the Company's operation and performance;

- Evaluating the Investment Manager's performance, succession and development plans;

- Reviewing and monitoring the Company's internal controls and procedures for financial reporting and compliance;

- Approving the nomination of Directors and appointments to the Board Committees;

- Ensuring that Directors recuse themselves from discussions and decisions where there is a potential conflict of interest;

- Determining the amount and timing of dividends and cash distributions;

- Reviewing management fees and performance fees in accordance with the terms of the investment management agreement; and

- Approving audit plans and financial reports.

The Board has established a Board Investment Committee ("BIC") to assist the Board in assessing all investments proposed by the Investment Manager. The members of the BIC are Mr Kin Chan and Mr Alex Shiu Leung Au representing the TIH Board, and Mr Wang Ya-Lun Allen representing the Investment Manager. The Investment Manager has also formed a Manager Investment Committee ("MIC") to assess investment and divestment decisions under the TIH Group. The MIC consists of senior investment personnel whom are Mr Wang Ya-Lun Allen and Mr Stanley Wang. Upon unanimous approval by the MIC, investment proposals will be recommended to the BIC for review and oversight. Unless a proposal involves confl ict of interest related matter and/or interested person transaction ("IPT") which falls under the Audit Committee's purview, the BIC has the authority to veto any proposal presented by the MIC. In the event (for whatever reason) the MIC is reduced to a single member, the decisions of the sole member of the MIC shall prevail.

Generally, investment/divestment transactions will be duly analysed by TIHIM's investment professionals and tabled to the MIC for consideration as proposed transactions ("Proposals"). The MIC will subject such Proposals to a thorough review process, including discussions with the relevant investment professionals on the basis for their Proposals, prior to taking a vote. The criteria considered by the MIC in making a decision on such Proposals includes, inter alia, the potential growth of the proposed business model, the experience of the management team, and the relevant risk-reward profiles. Following MIC approval, if the BIC does not veto the Proposal, the investment will proceed. In fulfilment of the requirements of the Capital Markets Services licence ("CMS Licence") from the Monetary Authority of Singapore ("MAS"), TIHIM has given an undertaking that where Mr Kin Chan as a BIC member vetoes an investment opportunity ("Rejected Investment Opportunity"), it shall ensure that none of Mr Kin Chan's business interests enters into, or engages, participates or invests in, the Rejected Investment Opportunity for a period of at least 6 months from the date on which the investment decision of the BIC is effected.

In addition, the Board has established Audit Committee ("AC"), Nominating and Remuneration Committee ("NRC"), and Risk Governance Committee ("RGC") (collectively referred to as "Board Committees") to assist the Board in the execution of its duties. Each of these committees discharges its duties under its respective terms of reference as approved by the Board and recommends relevant issues to the Board for action. The functions and terms of reference of each Board Committee are set out in the later parts of this Statement.

The Company has clear guidelines on matters to be approved by the Board. Below is a non-exhaustive list of material transactions which require Board approval:

- Appointment of directors as well as the size and composition of the Board and its committees;

- Recommendation for appointment/re-appointment of external auditors and approval of audit fees;

- Appointment of internal auditors;

- Engagement of professional services for corporate actions including but not limited to capital reduction, bonus issue, rights and warrants issuance;

- Approval of corporate announcements for matters including but not limited to half-yearly financial reports, circulars, annual reports, sustainability reports, etc;

- Approval of establishment/termination of bank accounts, banking facilities, loans and credit facilities and signing mandates;

- Approval of any amendments to the Investment Management Agreement, Strategic Support Services Agreement and investment policies;

- Approval of IPTs;

- Approval of interim dividend payments and recommendation of final dividend payments;

- Veto rights on investment proposals via the BIC; and

- Any other matters for which the Board is responsible or has delegated to its committees under relevant laws and regulations.

Board and Board Committee Meetings

The Board and Board Committee meetings are scheduled well in advance in consultation with the Directors. In addition to attending in person at the meeting venue, participation in Board or Board Committee meetings via telephone/web conferences or other forms of audio or audio-visual communication is also permitted under TIH's Constitution. The Investment Manager aims to provide complete, adequate and timely information to the Board and Board Committees prior to meetings and on an on-going basis to enable them to make informed decisions and discharge their duties and responsibilities. The notice and agenda for meetings and board papers including, amongst others, minutes of meetings, half-year and full year financial statements, budgets, financial plans, audit plans, investments/divestments update, legislative/regulatory/governance changes, Director's interest disclosures, proposals and reports are provided to the Board and Board Committees well in advance of the scheduled meetings to prepare the Directors for the meetings.

There are at least four scheduled Board meetings held each year. In addition, ad hoc non-scheduled Board and/or Board Committees meetings are convened when necessary to deliberate on urgent substantial matters. The Board and Board Committees also relied on circular resolutions and discussions conducted via telephonic conferences, email and other forms of communication to discharge their duties. In addition, Board members meet outside of scheduled meetings without management executives for discussions and updates.

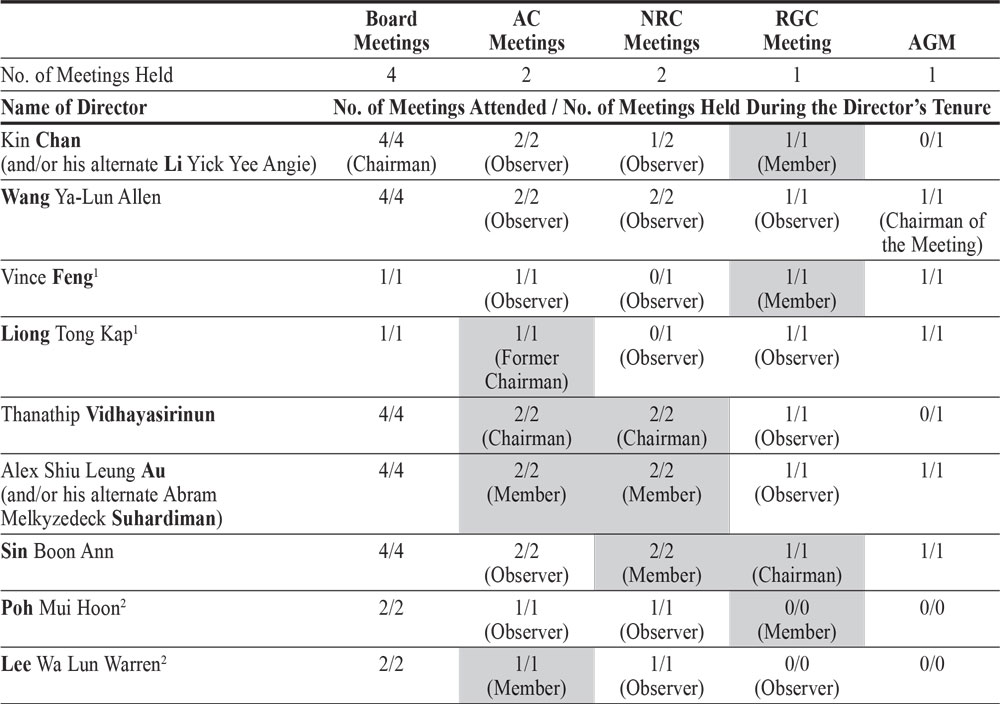

There were four (4) Board meetings, two (2) AC meetings, two (2) NRC meetings, one (1) RGC meeting and one (1) Annual General Meeting ("AGM") held in 2024. Directors actively participate in Board and Board Committee meetings. The attendance of such meetings by the Directors is tabulated below.

2024 Board, Board Committee and General Meetings Attendance

(Please refer to "Board Composition" section of this Statement for the existing composition of the Board and Board Committees.)

Notes:

- Messrs Liong Tong Kap and Vince Feng retired as Independent Non-Executive Directors at the AGM held on 25 April 2024. Accordingly, Mr Liong ceased to be the AC Chair and Mr Vince Feng ceased to be a RGC member and BIC member.

- Ms Poh Mui Hoon and Mr Lee Wa Lun Warren were appointed as Independent Non-Executive Directors on 23 May 2024. Accordingly, Ms Poh was appointed as a RGC member and Mr Warren Lee was appointed as an AC member.

As a standing practice, Board members are invited by the AC Chairman to attend the AC meetings as observers. Similarly, all Directors are also invited to be observers at meetings of other Board Committees, which are held on an annual basis.

Access to Information

The Board is responsible for providing a balanced and understandable assessment of the Company's performance, position and prospects. To support this, the Investment Manager provides periodic reports on the Company's performance and prospects, including quarterly performance updates on the investments. Semiannually, the external auditors review investment performance for compliance with investment guidelines and valuation principles, and any changes in investment valuations are communicated to the Board. The Board receives financial results alongside updated investment valuations, ensuring transparency and alignment with valuation standards. These report together with other meeting materials will be included in the Board Book to be distributed to the Board at least one week before each meeting.

To facilitate an effective and efficient discharge of duties and responsibilities, the Directors are provided with timely updates on major developments in investments and divestments. The investor reports along with the Company's corporate documents, including annual reports, circulars, and TIH's Constitution; the terms of reference for each Board Committee; and the Group's various policies, are made available on a secure shared drive for Directors to access as needed.

Access to Management, Company Secretary and Professional Advice

The Board also has separate and independent access to senior management of the Investment Manager, Company Secretary as well as to the internal and external auditors. To facilitate the Directors' discharge of their duties, when independent professional advice is required, it is proposed to the Board with relevant quotations of fees of such advice for the Board's approval. Upon the Board's approval, such expense is borne by the Company.

Under the direction of the Investment Manager, the Company Secretary, who attends all Board and Board Committees' meetings, ensures effective communication between the Company and its Directors as well as to facilitate orientation and professional development as required. The Company Secretary also ensures board and meeting procedures are followed and applicable laws and regulations are complied with. The appointment and removal of the Company Secretary are subject to the approval of the Board as a whole.

Directors' Training and Development

To ensure that Directors keep pace with regulatory changes that will have an important bearing on the Company's or directors' disclosure obligations, the Directors are briefed during Board and Board Committee meetings and specially prepared materials on the relevant matters are provided in the Board Book which is distributed to the Directors at least one week before each meeting. In addition, the Company allows each Director to claim professional training fees on a per annum basis as approved by the Board from time to time. All Board members are encouraged to keep abreast of current legislation and Directors can attend relevant and suitable courses as part of their director training. During the year, Directors attended various training courses/seminars covering topics such as sustainability, compliance, regulatory matters and economic outlook. Courses/seminars include:

- The Importance of Diversity in Judicial and Arbitrator Decision-Making

- SID Event - Audit and Risk Committee Seminar 2024

- Understanding the New Administrative Guidance on the Global Minimum Tax Rules

- KPMG Asset Management Series: Demystifying the Financial Resources Rules

- Climate Reporting Mandate in Singapore - Latest Announcements Impacting Listed Companies

- Volunteer Capability Building Series 2024 VolCapB Series: Understanding the Protection from Harassment Court

- Decarbonising India Industries

- Striking the Right Balance in Allocations

- Assessment of Damages caused by the Russian-Ukranian Conflict

- Managing Operational Risk in M&A Transactions

- Carbon Credit

- Business and Legal Issues for Directors and Executives

- Navigating AML Compliance In Asia: Insights And Strategies For 2024 And Beyond

- Heightened Expectations: Sales & Suitability in The Digital Era

- SID Event - CTP 20: Directors Sued/Charged - Lessons from Recent Cases

- SID Event - Nominating and Remuneration Committee Seminar, Behind Closed Doors: Key Decisions and Insights from NRCs

- Navigating the CSRD and Global Reporting Standards for Singapore companies

- SID Directors Conference 2024

- Market Misconduct

- SID Fellows Event

- SID LED9 – Environmental, Social and Governance Essentials (Exchange-prescribed training)

- Let's Stay Alert for Recent Regulatory Concerns

- Global Commodities and the Race for the White House

- Global M&A Outlook Series

- Asian Business Dialogue on Corporate Governance 2024

- Sustainability E-Training for Directors (Exchange-prescribed training)

- AML & CFT and Sanctions for Cayman Islands Fund Directors

Pursuant to Rule 720(7) of the Listing Manual, all of the Directors have undergone at least one required training on sustainability matters as prescribed by the Exchange. Additionally, Ms Poh Mui Hoon, who does not have prior experience as a director of an issuer listed on the Exchange, undertook other trainings on the roles and responsibilities of a listed issuer, as prescribed by the Exchange, prior to her appointment. Newly appointed Directors are briefed by the Investment Manager on the Company's business activities, policies, regulatory and governance environment as well as statutory and other duties and responsibilities of Directors. Where required, the Company provides appropriate training and briefing programme for new Directors.

Board Composition and Guidance

Principle 2: The Board has an appropriate level of independence and diversity of thought and background in its composition to enable it to make decisions in the best interests of the Company.

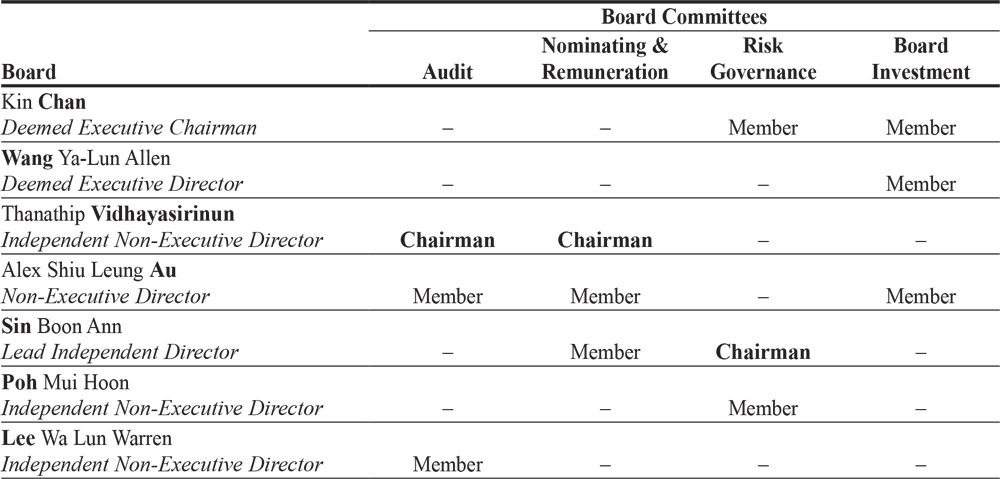

Board Composition

As the Chairman of the Board, Mr Kin Chan, a Deemed Executive Director ("Board Chairman"), is not independent, the Board is made up of a majority of Independent Directors (4 out of 7) in line with the Code's provision. Non-Executive Directors which include the Independent Directors (5 out of 7) make up a majority of the Board. Out of the 3 non-independent Board members, the Board Chairman and Mr Alex Shiu Leung Au, a Non-Executive Director, are affiliated with Substantial Shareholders and Mr Wang Ya-Lun Allen, Deemed Executive Director, is affiliated with the Investment Manager. Mr Alex Au, being a Non-Executive Director, is not an employee of the Investment Manager and does not participate in the Company's day-to-day management. Mr Thanathip Vidhayasirinun, Mr Sin Boon Ann, Ms Poh Mui Hoon and Mr Lee Wa Lun Warren are the 4 Independent Non-Executive Directors.

The composition of the Board and Board Committees as at the date of this Annual Report are set out below:

Non-Executive Directors

Most of the Non-Executive Directors have in-depth knowledge and experience in investment/fund management industry. They have been performing their duties including:

- constructively challenge the Investment Manager and help develop proposals on strategy;

- review the performance of the Investment Manager; and

- performing their roles in each of the Board Committees.

In addition, with the help of auditors and advisors, the Independent Directors provide an independent objective check on the Investment Manager, acting in the best interests of the Company as a whole and not of any particular group of Shareholders or stakeholders.

As and when necessary, Non-Executive Directors, led by the Lead Independent Director, meet for confidential discussions on any concerns and to resolve confl icts of interest, without the presence of the Investment Manager and the Lead Independent Director provides feedback to the Board and/or Board Chairman as appropriate.

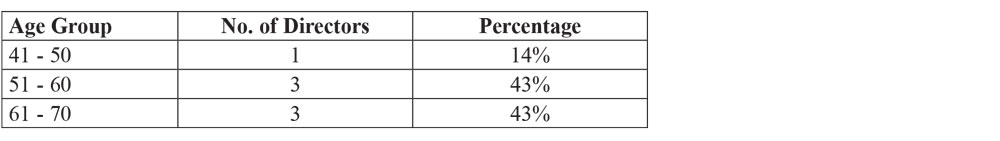

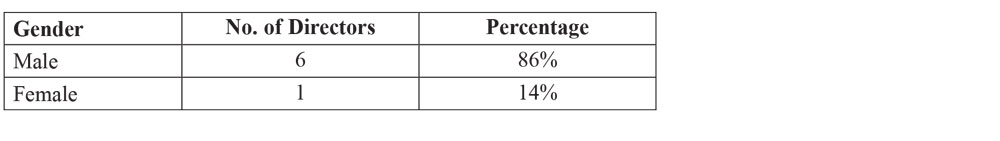

Board Diversity

A Board Diversity Policy has been adopted in February 2022 and addresses gender, skills and experience, and any other relevant aspects of diversity. The Company's board diversity in the aspects as breakdown below enables the Board to have a broader range of insights, perspectives and views in relation to issues aff ecting the Company. All Board members met the required academic qualification requirements.

Age Group (as at 31 December 2024)

Gender

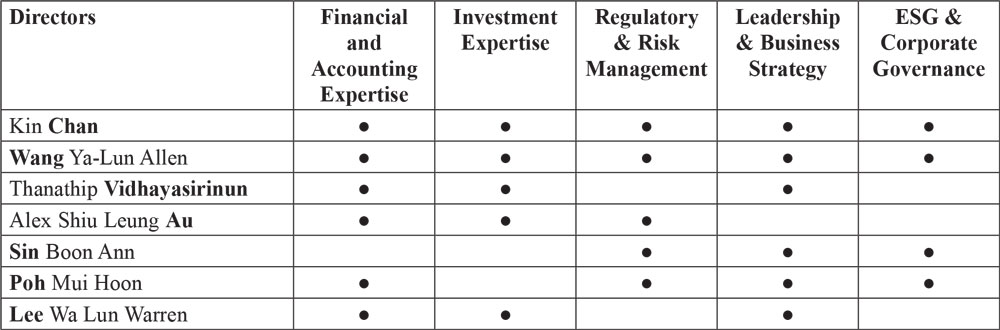

Skills, Industry Experience, Capabilities and Strength

Below is the matrix showing the diversity of skills, industry experience, capabilities and strength of the Board.

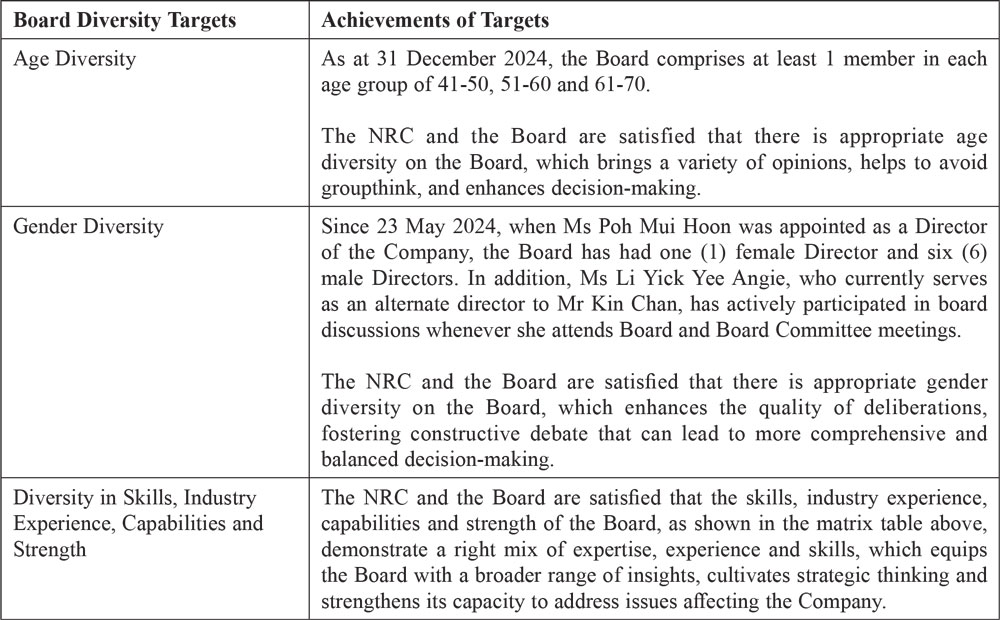

The Company strives to achieve the following Board Diversity Targets:

In FY2024, the Board with the aid of the NRC had performed the necessary annual reviews and had determined that:

- the Board has an appropriate level of independence to enable it to make decisions in the best interests of the Company;

- taking into account the nature and scope of the Company's activities, the Board and Board Committees are of an appropriate size for effective debate and decision-making; and

- the Board has the right mix of expertise, experience and skills and comprises persons who as a group are representative of the principal shareholders of the Company and provide the competencies required for the Board to be effective and to meet the Company's objectives.

Chairman and Chief Executive Officer

Principle 3: There is a clear division of responsibilities between the leadership of the Board and Management, and no one individual has unfettered powers of decision-making.

The Company recognises that in order to achieve a balance of power and authority for independent decision making, there should be a clear division of responsibilities between the Board Chairman and the Chief Executive Officer ("CEO").

The Company does not have a CEO as its management has been seconded to the Investment Manager. The Investment Manager manages the day-to-day business and administration of the Company pursuant to the investment management agreement. Mr Wang Ya-Lun Allen is the CEO of the Investment Manager and as such he is a Deemed Executive Director of the Company.

The Board has established and set out in writing the division of responsibilities between the roles of the Board Chairman, who led and ensure the effectiveness of the Board and the roles of the CEO (the Investment Manager), who manages the Company's business operations. There is no immediate familial relationship between the Board Chairman and the employees of the Investment Manager. The roles of the Board Chairman and CEO (the Investment Manager) are held by separate parties, ensuring that no one has unfettered decision-making power.

Roles and Responsibilities of the Board Chairman

The Board Chairman, Mr Kin Chan, had been a Non-Executive Director of the Company since his appointment to the Board on 1 October 2004. On 1 July 2016, the Investment Manager obtained its CMS Licence from the MAS. Due to Mr Chan's role as a BIC member, Mr Chan is a licenced representative of the Investment Manager. Following his appointment as a licenced representative of the Investment Manager on 26 August 2016, Mr Chan is deemed as an Executive Director of the Company. However, other than being a BIC member, he does not have any executive role in the day-to-day operations of the Company. His duties and responsibilities in TIH remain the same as before obtaining the CMS License which include, amongst others:

- leading the Board to ensure its effectiveness on all aspects of its role;

- ensuring that regulations and procedures relating to Board meetings are complied with;

- setting board agenda and conducting effective Board meetings;

- promoting a culture of openness and debate at the Board;

- facilitating the effective contribution of all Director;

- encouraging constructive relations within the Board and between the Board and the Investment Manager;

- ensuring effective communication with Shareholders and other stakeholders; and

- ensuring high standards of corporate governance.

The Board Chairman also engages with TIH's strategic partners, key associates such as prominent Asian families and sovereign wealth funds. He fosters strong relationships with the Company's partners and gathers valuable feedback for follow-up.

Lead Independent Director

In view that the Board Chairman is not an independent director, the Board has appointed a Lead Independent Director. The current Lead Independent Director is Mr Sin Boon Ann, who has assumed this role since 1 January 2021. The Lead Independent Director provides leadership in situations where the non-independent Board Chairman is confl icted and addresses any Shareholders' concerns that cannot be resolved or are inappropriate to be handled through the normal channels of the Board Chairman or the Investment Manager.

Roles and Responsibilities of the Investment Manager

The management and operations of the Company had been delegated to the Investment Manager. The Investment Manager's primary role is to identify and evaluate opportunities for investment of the Company's funds in accordance with the investment policies as provided for in the Company's Prospectus (as amended and approved by the Board from time to time) and to provide related services in connection with the Company's investments and other advisory services. Its duties and responsibilities also include:

- running of the Group's business in accordance with written policies/code of conduct and ethics such as the ICCM;

- responsible for leading the executive team in implementing the decisions of the Board; and

- reporting to the Board on the performance of the Company.

Board Membership

Principle 4: The Board has a formal and transparent process for the appointment and re-appointment of directors, taking into account the need for progressive renewal of the Board.

Nominating and Remuneration Committee

The NRC, meets at least annually and consists of the following members:

Thanathip Vidhayasirinun - Chairman (Independent and Non-Executive Director)

Sin Boon Ann (Lead Independent Director)

Alex Shiu Leung Au (Non-Executive Director)

The nominating functions of the NRC, set out in its terms of reference, are as follows:

- Review the succession plans of Directors, in particular the appointment and/or replacement of the Chairman;

- Recommend the appointment and re-appointment of the Directors (including alternate directors, if any);

- Determine annually, and as and when circumstances require, if a Director is independent, having regard to the circumstances set forth in the Listing Manual and the Code, and ensure that the independent Directors comprise a majority of the Board as the Board Chairman is non-independent;

- Make recommendations to the Board on the process and criteria for evaluation of the performance of the Board, its committees and Directors;

- Recommend for the Board's approval the objective performance criteria and process for the evaluation of the effectiveness of the Board as a whole, and of each Board Committee separately, as well as the contribution by the Chairman and each individual director to the Board;

- Review training and professional development programmes for the Board and the Directors;

- Report to the Board with regard to these terms of reference;

- Review the results of the Board's annual self-assessment and suggest to the Board any recommendations/actions in respect of the self-assessment results; and

- Ensure that new members of the Board are aware of their duties and obligations.

Succession Plans

In FY2024, the NRC reviewed the Board succession plans, in particular, the Board Chairman. As the Company has no CEO or employees, no succession review is required for the roles of CEO and key management personnel. The NRC and the Board have the consensus that as the Board Chairman represents a major shareholder, a formal succession plan for this role is unnecessary in the foreseeable future. In the unlikely event of a sudden vacancy in the Chairman position, the Board members possess the quality and capability to serve as interim Chairman while a search is conducted for a successor.

To support the progressive renewal of the Board and ensure timely replacement of independent directors who have served more than nine years in accordance with the Listing Manual, the Company is constantly monitoring potential vacancies and sourcing suitable candidates that align with the Board Diversity Policy. The process for selection, appointment and re-appointment of Directors is part of the Company's broader approach to maintaining Board continuity and governance, which is discussed in the following section.

Selection, Appointment and Re-Appointment of Directors

In line with the Board Diversity Policy, all appointments to the Board will be assessed by the NRC for required academic qualifications, skills, experience, capabilities and strengths. Other relevant criteria, such as independence, other principal commitments and potential impact on boardroom dynamics, will also be taken into consideration as appropriate. The NRC is mindful of the need to consider diversity on the Board in terms of personal attributes such as gender and age when filling up vacancies.

The procedure for the selection of new Board members is as follows:

- When a board vacancy arises, Board members source and recommend suitable candidates to the NRC. During the search process, the NRC taps on the personal contacts of current Directors and senior management for recommendations of prospective candidates. Where necessary, the NRC may also use third-party executive/Board search firms at the Company's expenses. The curriculum vitae of each potential director is circulated to all Board members;

- NRC members arrange interviews with the short-listed candidate(s) and appraise them to ensure they meet the established criteria; and

- If a candidate is deemed suitable, the NRC discuss the final choice with the Board members and the chosen candidate is off ered the directorship position.

Article 107 of TIH's Constitution provides that one-third of the Directors for the time being, or if their number is not a multiple of three, the number nearest to but not less than one-third with a minimum of one shall retire from office and a retiring Director at an AGM shall retain office until the close of the AGM. In addition, Article 111 of TIH's Constitution sets forth that any Director appointed to fill a casual vacancy or as an additional Directors shall hold office only until the next AGM but shall not be taken into account in determining the number of Directors who retire by rotation at such AGM.

A retiring Director is eligible for re-election by Shareholders at the AGM. The Directors to retire in every year shall be those who being subject to retirement by rotation have been longest in office since their last election or appointment or have been in office for the three years since their last election. However, as between persons who became or were last re-elected Directors on the same day, those to retire shall (unless they otherwise agree among themselves) be determined by lot.

At the forthcoming AGM to be held in April 2025 ("2025 AGM"), the Directors subject to retirement by rotation in accordance with Article 107 of TIH's Constitution are Messrs Alex Shiu Leung Au and Sin Boon Ann. Directors ceasing to hold office in accordance with Article 111 of TIH's Constitution are Ms Poh Mui Hoon and Mr Lee Wa Lun Warren. All four Directors, being eligible, have submitted their consents to seek re-election.

With relevant NRC members or Directors abstaining from deliberating on their own nominations, the NRC has, after considering board diversity and each of the four Directors' contributions and performances (e.g. attendance, preparedness, participation and candour) recommended, and the Board has accepted, that Mr Alex Shiu Leung Au, Mr Sin Boon Ann, Ms Poh Mui Hoon and Mr Lee Wa Lun Warren be nominated for re-election at the 2025 AGM.

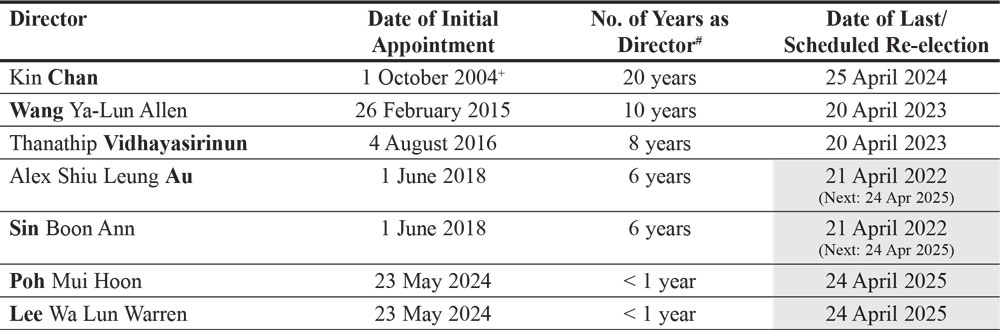

The date of initial appointment and last re-election/scheduled re-election of Directors are set out below:

Notes:

# As at date of this Annual Report

+ Appointed as Chairman of Board on 1 May 2005

Assessment of Independence

All Independent Directors are required to complete a confirmation of independence, which set out all the independence criteria and circumstances in line with Listing Manual and the Code, annually and as and when required. Mr Sin Boon Ann and Ms Poh Mui Hoon disclosed to the Company that they have a business relationship with each other and with a substantial shareholder of the Company. The substantial shareholder, through its wholly owned subsidiary, made a venture capital investment in a start-up company where Mr Sin is the chairman and founder and Ms Poh is a non-independent director and co-founder.

During FY2024, the NRC conducted its annual review, taking into consideration the following:

- the declarations of independence from all four Independent Directors, confirming that they meet the independence criteria and circumstances in line with the Listing Manual and the Code; and

- the confirmations by Mr Sin Boon Ann and Ms Poh Mui Hoon, particularly, that they are neither accustomed nor under any obligation, formally or informally, to act in accordance with the directions of the substantial shareholder and/or its wholly owned subsidiary, and therefore are not directly associated with the substantial shareholder as described in Practice Guidance 2 to the Code.

With relevant NRC members or Directors abstaining from deliberating on their own independence, the NRC, based on its review, is satisfied that the business relationship between Mr Sin and Ms Poh as well as their business relationship with the substantial shareholder, has not impaired their independent status in TIH. Accordingly, the NRC, together with the Board, has determined that Mr Thanathip Vidhayasirinun, Mr Sin Boon Ann, Ms Poh Mui Hoon and Mr Lee Wa Lun Warren remain independent.

The NRC has used its best efforts to ensure that the Board comprises members who represent strategic shareholders as well as independent members who will enhance governance in the interests of all Shareholders.

Multiple Board Representations and Principal Commitments

When a Director has multiple board representations and other principal commitments, they are expected to ensure that sufficient time and attention are given to the aff airs of the Company. The NRC shall review with Board members in an open session the effectiveness of the Board, its committees and the contributions of each Director to determine whether the Board and its members are able to and have been adequately carrying out their respective duties as Directors of the Company.

While the number of board representations should not be the only measure of a Director's commitment and ability to contribute effectively, the NRC takes the view that approval from the Board should be obtained if a Director wishes to exceed the maximum number of board representations on listed companies as determined by the Board. In assessing a Director's contributions, the NRC takes a holistic approach. Focusing solely on Directors' attendance at Board and Board Committee meetings per se may not provide an adequate evaluation of the contribution of the Directors. Instead, their abilities to provide valuable insights and strategic networking to enhance the businesses of the Group, availability for guidance and advice outside the scope of formal Board and Board Committee meetings and expertise in specialised areas are also relevant factors in assessing their contributions.

For FY2024, the NRC and the Board are satisfied that the number of listed company board representations held by all Board members does not exceed the limit set by the Board and the Company respects each Director's judgement on their own time commitments for their directorships and principal commitments. Based on an annual review, the NRC and the Board are of the opinion that all Directors have been adequately carrying out their duties as Board members. None of the Directors have informed the Company of previously serving on the board of a company with an adverse track record or with a history of irregularities or is or was under investigation by regulators.

The listed company directorships and principal commitments of each Director are disclosed under section "Key Information on Board Members" of this Statement.

Board Performance

Principle 5: The Board undertakes a formal annual assessment of its effectiveness as a whole, and that of each of its Board committees and individual directors.

Once a year, the Board conducts a self-assessment to evaluate its effectiveness as a whole, the effectiveness of each Board Committee, and the contribution of the Chairman to the Board. The annual assessment is conducted in form of checklist, which the Company Secretary distributes to each Board member for completion. The Company Secretary compiles the assessment results, together with any feedback and recommended action plan from the Directors, into a report to be presented at the NRC and Board meetings for review and discussion. The Board Chairman determines whether any action is required. The Company has not engaged any external facilitator to assist with the annual assessment.

The checklist evaluates the following performance criteria: (A) Board Structure and Composition, including the independent element and the right mix of expertise, experience and skills of the Board; (B) Conduct of Meetings, including the Board Chairman's promotion of Board culture and high standards of corporate governance, Directors' full discussion at the meetings and access to information and management; (C) Board Accountability, including consideration of the long-term future and strategy, line of commentaries and responses to crises and urgent issues; (D) Corporate Strategy and Planning, including sustainability issues and Board succession; (E) Risk Management and Internal Controls, including the establishment of a control system and the identification of significant weaknesses in control procedures; (F) Measuring and Monitoring Performance, including share performance and dividend payouts; (G) Communicating with Shareholders, including ensuring Shareholders have the opportunity to participate effectively at AGMs; (H) Financial Reporting, including the review of results announcements; (I) Compensation, including the review and endorsement of the remuneration framework; and (J) Committee effectiveness, including meeting regulatory requirements and fulfilling responsibilities as set out in the respective terms of reference. The NRC has recommended these performance criteria, which have been approved by the Board. These criteria are not subject to change unless necessary, and any changes must be recommended by the NRC and approved by the Board.

The Board is cognizant of the recommendation under Principle 5 of the Code for a formal annual assessment of individual directors. However, the Board believes that the existing assessment, which evaluates the effectiveness of the Board as a whole, each Board Committee separately, and the contribution of the Board Chairman adequately meets TIH's needs. The Board underscores that delivering Shareholder value and protecting minority interests remain priorities and these considerations have been incorporated into the performance criteria for the annual assessment.

Remuneration Policies, Framework and Disclosure

Principle 6: The Board has a formal and transparent procedure for developing policies on director and executive remuneration, and for fixing the remuneration packages of individual directors and key management personnel. No director is involved in deciding his or her own remuneration.

Principle 7: The level and structure of remuneration of the Board and key management personnel are appropriate and proportionate to the sustained performance and value creation of the company, taking into account the strategic objectives of the company.

Principle 8: The company is transparent on its remuneration policies, level and mix of remuneration, the procedure for setting remuneration, and the relationships between remuneration, performance and value creation.

Developing Remuneration Policies and Framework

The NRC, with its composition stated in the previous section, also performs the following remuneration functions as set out in its terms of reference:

- Review and recommend to the Board the framework for remuneration of the Directors taking into consideration industry practices, level of contribution/responsibility of the Directors and corporate performance;

- Review and recommend to the Board the specific remuneration packages for each Director; and

- Consider all aspects of remuneration, including termination terms, to ensure they are fair.

Directors' Remuneration and Management Fee to Investment Manager

As the Company has no direct staff nor employees and is managed by the Investment Manager under the investment management agreement, the NRC reviews only the remuneration framework of the Board. Mr Wang Ya-Lun Allen, a Deemed Executive Director, does not receive any Director's fee from the Company. Instead, he is remunerated by the Investment Manager through an employee's salary and bonus. Mr Kin Chan, the Deemed Executive Chairman, does not perform any executive role in the day-to-day operations of the Company and hence only receives Director's fee. The Investment Manager is a subsidiary of the Company and is paid a management fee in accordance to the terms of the investment management agreement. To align the interests of the Investment Manager with the interests of the Shareholders and to promote long-term success of the Company, the percentage of management fee is tiered such that 1% of the net asset value of the Company ("NAV") for NAV up to and including S$300 million; 0.5% for NAV above S$300 million up to S$500 million; and 0.25% for NAV which is above S$500 million. There is no performance fee or any other incentive fee agreed in the investment management agreement. Any changes to the terms of the investment management agreement will be subject to the Board's approval. In view of the foregoing, there is no requirement for the engagement of a remuneration consultant.

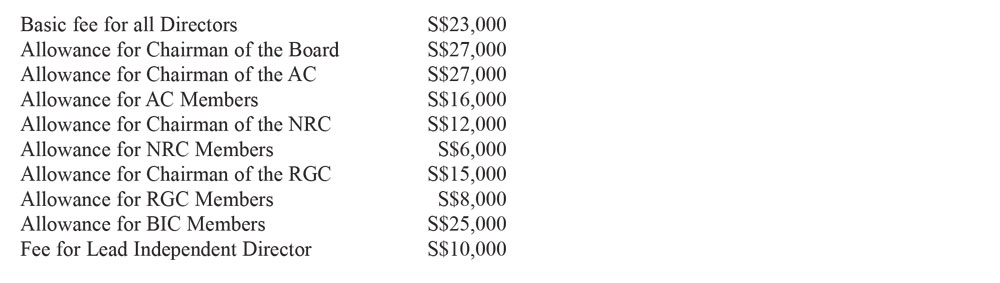

Taking into account of the following factors:

- the remuneration of non-executive/independent Directors is appropriate to the level of contribution such as effort, time spent and responsibilities;

- the chairman of the Board and each Board Committees are compensated for their additional responsibilities; and

- remuneration is appropriate to attract, retain and motivate the Directors to provide good stewardship of the Company.

the NRC recommends, and the Board has endorsed, the following schedule of Directors' fees payable for FY2024:

Directors who cease to hold office during the financial year will be paid pro-rated fees for their term of service. No additional fee is payable for meeting attendance and no Director decides on his own fees. The NRC, with the concurrence of the Board, is of the view that the remuneration is appropriate to attract, retain and motivate the Directors to provide good stewardship of the Company and the Investment Manager to successfully manage the Company for the long term.

Disclosure on Remuneration

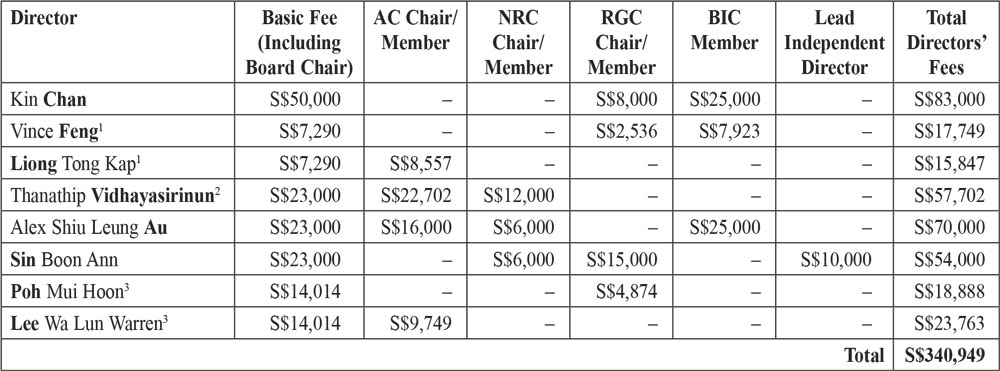

A breakdown of the Directors' fees to be paid to the following Directors for FY2024 upon approval by the Shareholders at the 2025 AGM is as follows:

Notes:

- Mr Liong Tong Kap and Mr Vince Feng retired from the Board at the conclusion of the AGM held on 25 April 2024, and accordingly, relinquished their respective memberships in the Board Committees on the same day.

- On 23 May 2024, Mr Thanathip Vidhayasirinun was re-designated from an AC member to AC Chair.

- Ms Poh Mui Hoon and Mr Lee Wa Lun Warren were appointed as Independent Non-Executive Directors of the Company on 23 May 2024, and accordingly, assumed their respective memberships in the Board Committees on the same day.

For FY2024, save and except for Directors' fees which are payable in arrears after approval by Shareholders at the AGM, no other forms of remuneration, termination, retirement and post employment benefits are paid or payable to the Directors by the Company.

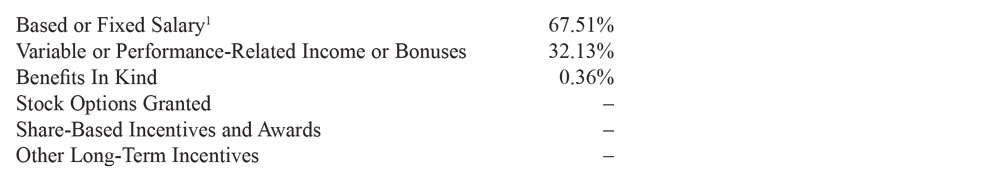

Mr Wang Ya-Lun Allen, the Deemed Executive Director of the Company and the CEO of TIHIM, was paid a total remuneration of S$498,547 for FY2024 by TIHIM. In accordance with Rule 1207(10D) of the Listing Manual, the breakdown of his remuneration for FY2024 (in percentage terms) is as follows:

Notes:

- Includes employer's contribution to the Central Provident Fund.

The Company and its subsidiaries do not have any employees who are Substantial Shareholders or are immediate family members of the Directors, the CEO or Substantial Shareholders, and whose remuneration exceeded S$100,000 during FY2024.

As the Company does not have any employees, there are no long-term incentive schemes such as an employee share option scheme.

For FY2024, the Investment Manager was remunerated with management fees computed based on the percentages agreed upon in the investment management agreement. Other than payment in lieu of notice in the event of termination, no other termination, retirement or post employment benefits were included in the employment contracts of TIHIM employees.

The Board mindful of the recommendation of Provision 8.1 of the Code to disclose the names, amounts and breakdown of the top five key management personnel (who are not Directors or the CEO) in remuneration bands of S$250,000, as well as the total remuneration paid to these key management personnel. However, the Board is of the view that disclosure of remuneration information of the senior management personnel of TIHIM is not in the best interests of TIH due to the sensitivity and confidential nature of such information in a competitive talent market. The Board is of the opinion that such disclosure may aff ect the retention or recruitment of competent personnel in a highly competitive business environment the Company operates in as well as the competitive pressures in the talent market due to limited talent pool. The Company needs to maintain stability and business continuity and any attrition in the key management personnel team would not benefit the Company. Accordingly, due to confidentiality and sensitivity issues attached to remuneration matters, especially in the case where TIHIM has less than 20 employees in FY2024, it would not be in the best interests of the Company to disclose remuneration of these key management personnel as recommended by the Code.

Risk Management and Internal Controls

Principle 9: The Board is responsible for the governance of risk and ensures that Management maintains a sound system of risk management and internal controls, to safeguard the interests of the company and its shareholders.

Risk Governance Committee

The RGC was set up to assist the Board in overseeing the Company's risk management framework and policies, and ensures that the Investment Manager maintains a sound system of risk management and internal controls. It assists the Board to determine the nature and extent of the significant risks which the Company is willing to take in achieving its strategic objectives and value creation. The RGC meets at least annually and consists of the following members:

Sin Boon Ann – Chairman (Lead Independent Director)

Poh Mui Hoon (Independent and Non-Executive Director)

Kin Chan (Deemed Executive Chairman)

The duties of the RGC, set out in its terms of reference, are as follows:

- Determine the nature and extent of the significant risks which the Company is willing to take in achieving its strategic objectives and value creation.

- Determine and review the Company's overall risk tolerance and strategy.

- Determine and review the current risk exposures and future risk strategy of the Company.

- In relation to risk assessment:

- keep under review the Company's overall risk assessment processes;

- review regularly and approve the parameters used in these measures and the methodology adopted; and

- set a process for the accurate and timely monitoring of large exposures and certain risk types of critical importance.

- keep under review the Company's overall risk assessment processes;

- Determine and review the Company's capability to identify and manage new risk types.

- Review proposed strategic transactions, focusing in particular on risk aspects and implications for the risk tolerance of the Company, and taking independent external advice where appropriate and available.

- Review any material breaches of risk limits and the adequacy of proposed action.

- Keep under review the effectiveness of the Company's internal controls and risk management systems.

- Monitor the independence of risk management functions throughout the organization.

- Review promptly all relevant risk reports on the Company.

- Review and monitor the Investment Management's responsiveness to the findings.

Enterprise Risk Management

The Company has an enterprise risk management framework ("ERM") which provides the RGC guidance for early identification and handling of risks. The ERM defines the risk management policies and procedures that the Company needs to be complied with. It provides a systematic and continuous approach to identifying and prioritising risks that can aff ect the organisation and also the corresponding countermeasures to the risks, where available and ultimately, reporting the assessment of risks and countermeasures in place to the highest authority in the organisation to enable monitoring and relevant decisions to be undertaken. Some common risk areas and their corresponding countermeasures under the ERM include operation risk, foreign exchange risk, interest rate risk, market risk, credit risk, liquidity risk and fraud risk, among others.

The Company has engaged BDO Advisory Pte. Ltd. ("BDO") to assist in the review of the risk governance matters on an annual basis. BDO is a member of BDO International Limited and forms part of international network of independent member firms. During the year, BDO conducts an annual review of the Company's business risks and control policies and processes and reported key findings and mitigating measures to the RGC and assisted the RGC in reviewing and updating the risk register based on the ERM. Key risks identified were updated in the risk register with countermeasures in place to address these risks. This register, which would be refreshed and reviewed annually, is meant to be an ongoing record of the major risks aff ecting the Company. Whenever the ERM exercise is extended to additional clusters, this register shall be updated.

Roles of Investment Manager on Internal Control and Risk Management

The operations of the Company have been delegated and assigned to the Investment Manager which is expected to exercise discipline in discharging its fiduciary responsibilities. The Investment Manager operates under the guidance of the ICCM, which is well documented and regularly updated, and every Director and staff of the Investment Manager is required to adhere to the ICCM as a condition of his/her employment. The ICCM includes, among other things, policies and procedures governing financial, operational, information technology ("IT") and regulatory compliance matters. In addition, the Investment Manager operates under a set of guidelines stipulated in the TIH Prospectus and any changes to these guidelines are subject to the approval of the Board. Compliance with these guidelines are verified half-yearly by the Company's external auditors.

For FY2024, the Investment Manager reported to the AC and the Board that a robust risk control policy is in place to minimise the impact of various risks on the Company's financial stability and long-term viability. A comprehensive risk management framework has been implemented, encompassing the identification, assessment and management of various types of risks, including financial risk, operational risk, IT risk and compliance risk. To further enhance risk oversight, the internal audit and enterprise risk management assessment have been outsourced to BDO. Additionally, an IT support vendor has been engaged to conduct annual server health checks and provide other IT support services, ensuring that IT-related risks are effectively managed.

Written Assurance from CEO and CFO of Investment Manager

The AC and the Board had received written assurance from the CEO and Chief Financial Officer ("CFO") of the Investment Manager that (i) the financial records of the Company have been properly maintained and the financial statements give a true and fair view of the Company's operations and financial position; and (ii) the risk management and internal control systems of the Company are adequate and effective.

Adequacy and effectiveness of Internal Controls and Risk Management

Based on the risk management framework, the internal control policies and procedures established, assurance from the Investment Manager, reviews performed by Board and its committees on relevant aspects as well as the evaluation conducted by the external and internal auditors, the Board, with the concurrence of the AC, is of the opinion that the Company's internal controls, addressing financial, operational, compliance and IT risks, and risk management systems are adequate and effective as at 31 December 2024 to address the risks that are relevant and material to its operations.

The Board acknowledges, however, that no system of internal controls and risk management can provide absolute assurance against poor judgement in decision-making, human error, losses, fraud, cyberattacks or other irregularities.

Audit Committee

Principal 10: The Board has an Audit Committee which discharges its duties objectively.

The AC consists of the following members:

Thanathip Vidhayasirinun - Chairman (Independent and Non-Executive Director)

Alex Shiu Leung Au (Non-Executive Director)

Lee Wa Lun Warren (Independent and Non-Executive Director)

None of the AC members have been a former partner or director of KPMG LLP ("KPMG"), the Company's external auditors. All members of the AC are appropriately qualified to discharge their responsibilities and all AC members have relevant accounting and/or related financial management experience. Key information on the AC members' academic and professional qualifications and experience is set out under the section "Key Information on Board Members" of this Statement.

The AC performs the following main functions, set out in its terms of reference:

- Review the significant financial reporting issues and judgements so as to ensure the integrity of the financial statements of the Company and any announcements relating to the Company's financial performance;

- Review the audit plans and scope of work of the external auditors;

- Review and recommend the full-year, half-yearly announcements and the financial statements of the Company and Group as well as the auditors' report thereon before submission to the Board for approval;

- Review the findings, if any, of the external auditors and internal auditors and the responses of the Investment Manager;

- Review the level of audit fees, nature and extent of non-audit services, cost effectiveness and terms of engagement of the external auditors;

- Make recommendations to the Board on appointment and/or re-appointment, or removal of external auditors after assessing the auditors' independence and objectivity;

- Review the policy, including the Whistleblowing Policy, and arrangements for concerns about possible improprieties in matters of financial reporting or other matters within its terms of reference to be safely raised, independently investigated and appropriately followed up on;

- Review at least annually with the Investment Manager and their auditors the adequacy and effectiveness of the internal controls and risk management systems in respect of the Investment Manager and the Company;

- Review legal and regulatory matters that may have a material impact on the financial statements, related compliance policies and programmes and any reports received from regulators;

- Review IPTs in accordance with the requirements of the Listing Manual;

- Review and resolve any potential confl icts of interest between the Investment Manager and the Company;

- Review the assurance from the CEO and CFO of the Investment Manager on the financial records and financial statements;

- Review the adequacy, effectiveness, independence, scope and results of the external audit and the Company's internal audit function. The AC also decides on the appointment, termination and remuneration of the head of the Company's internal audit function or engagement of internal auditors and review of its terms of engagement, where applicable; and

- Meet with the external auditors, and with the internal auditors, in each case without the presence of the Company's management, at least annually.

The AC has full discretion to (i) invite any Director and any staff member of the Investment Manager to attend its meetings; (ii) require any such Director and any staff member of the Investment Manager in attendance to leave the meetings to facilitate open discussion on any matter that may arise; and (iii) investigate any matter within its terms of reference with full access to and co-operation by the Investment Manager. The AC also handle any other matters for which it is responsible under relevant laws and regulations.

During the year, KPMG, the external auditors, and BDO, the internal auditors, presented their findings and recommendations to the AC in the presence of other Board members and management. There were no instances of suspected fraud, irregularity or infringement of Singapore laws or regulations, that were reported to the AC as having or being likely to have a material impact on the Company's operating results or financial position. Additionally, the AC met separately with the external auditors and the internal auditors, in each case without the presence of management. KPMG periodically update the AC and the Board on key changes to reporting standards and regulatory requirements, enabling AC and Board members to keep abreast of such changes and their potential impact on the Group's financial statements or other reports. From time to time, Directors are also invited to attend seminars, talks and updates conducted by accounting firms and the Exchange on changes to accounting standards and current issues.

Review of Independence, Objectivity and Performance of External Auditors

The AC has reviewed and confirmed that the aggregate amount of fees paid/payable to KPMG for FY2024 is $330,000, comprising $291,800 audit fees and $38,200 non-audit fees (12% of total fees).

The AC reviewed all non-audit services provided by KPMG and noted that the fees paid to the external auditors for non-audit services during the financial year does not exceed 50% of the total amount of fees paid to the auditors. Having considered that the non-audit fees arose primarily from tax compliance services which were not prohibited services and do not pose a threat to the external auditors' independence, the AC is satisfied that the nature and extent of such services and the corresponding fees would not aff ect the independence and objectivity of KPMG.

In line with the International Ethics Standards Board for Accountants' revised non-assurance service standards, the AC adopted a Non-Assurance Services Pre-Approval Policy in November 2022, setting out a list of nonassurance services pre-approved by the AC. Additionally, the AC delegated authority to Mr Wang Ya-Lun Allen to approve services not included on the pre-approved list, provided that such approvals are reported to the AC at or prior to its next scheduled meeting.

The AC also assessed KPMG's performance and the quality of their work based on the Audit Quality Indicators Disclosure Framework published by the Accounting and Corporate Regulatory Authority of Singapore, and is pleased to recommend their re-appointment. As approved by the Board, the re-appointment of KPMG as the external auditors is subject to Shareholders' approval at the 2025 AGM.

The AC noted that Ms Ng I-Jane, a partner at KPMG who is in charge of the audit of TIH's group of companies, was appointed effective FY2022. Her tenure has not exceeded 5 consecutive full financial year audits, in accordance with Rule 713 of the Listing Manual. The AC also confirmed that the Company complies with Rules 712 and 715 of the Listing Manual in relation to its auditing firm.

Review of Interested Person Transactions

- Mandated IPT

The AC reviews the IPTs conducted under Shareholders' mandate adopted at the Extraordinary General Meeting of the Company held on 11 September 2018, whereby Shareholders approved the Interested Persons Transactions Mandate ("IPT Mandate") with Argyle Street Management Holdings Limited and its associates subject to the review procedures as stated in the Circular dated 27 August 2018. The review procedures are established to ensure that the mandated IPTs are undertaken on an arm's length basis and on normal commercial terms. The Company has put in place a register recording (i) all mandated IPTs; (ii) the amount of monies at risk for the entity at risk group in connection with each mandated IPTs; (iii) the basis for determining the transaction amounts/prices (as the cases may be); and (iv) supporting evidence obtained to support the aforementioned basis. The AC reviews the report of all recorded IPTs entered into by the Company, its subsidiaries and associated companies which are considered to be entities at risk", in their ordinary course of businesses, to ascertain the guidelines and procedures established has been adhered with. In the event that a member of the Board, a member of the AC, a member of the MIC, a member of the BIC or an authorised reviewing officer (where applicable) has a confl ict of interests in relation to any mandated IPT, he/she will abstain from reviewing that particular transaction. The details of the IPT Mandate, as proposed for renewal at the 2025 AGM, are set out in the Appendix to the Company's Letter to Shareholders dated 4 April 2025.

- Non-Mandated IPT

IPTs not covered under the IPT Mandate, if any, are reported to the AC and the Board to ensure that such transactions are conducted on an arm's length basis and on normal commercial terms that are not prejudicial to the interests of the Company and its minority shareholders. The Company will announce, disclose and seek Shareholders' approval for such IPTs in accordance with the requirements of the Listing Manual, where applicable.

- Strategic Support Services Agreement

With effect from 1 July 2014, via a strategic support services agreement ("Strategic Support Services Agreement"), the Company has appointed ASM Administration Limited - an associate of Mr Kin Chan, the Deemed Executive Chairman and a Controlling Shareholder, and Mr V-Nee Yeh, also a Controlling Shareholder of the Company - to provide the services of sourcing of potential investment opportunities for the Company. This support arrangement formalizes the strategic alliance between the Company and Argyle Street Management group ("ASM Group") and allows the Company to tap into the sourcing network of ASM Group for potential investment opportunities. The services provided under the Strategic Support Services Agreement include but not limited to the following:

- To provide on-site due diligence services in target countries.

- To provide on-the-ground local research activities in target countries, which include conducting meetings with and obtaining introduction to, local business partners and advisors in target countries.

The annual renewal of the Strategic Support Services Agreement is a regular agenda item at AC and Board meetings. In FY2024, the AC and the Board, having reviewed the proposed fee level, the terms of the support arrangement and a benchmarking study performed by an independent consulting firm (for the fees and services provided), are of the view that the support arrangement is entered into on an arm's length basis, on normal commercial terms, and is not prejudicial to the interests of the Company and its minority shareholders. Accordingly, the renewal of the Strategic Support Services Agreement was approved with an increased fee from US$515,000 to US$600,000 per annum.

- To provide on-site due diligence services in target countries.

- IPT Disclosure

As required by the Listing Manual, details of the IPTs, whether covered under IPT Mandate or not, entered by the Group are delineated in "Supplementary Information: Interested Person Transactions" section of this Annual Report.

Whistleblowing Policy

The Company has adopted a Whistleblowing Policy which has been endorsed by the AC. The Whistleblowing Policy is to provide an avenue for employees of the Investment Manager to bring to the attention of the AC or Lead Independent Director, major concerns of any wrongdoing or improprieties within the Company relating to unlawful conduct, financial malpractice, violation of rules, regulations or policies or a direct threat to the interest of the Company that has taken place or is likely to be committed.

The Whistleblowing Policy is intended to provide a framework to promote responsible and secure whistleblowing without fear of adverse consequences. It allows for reporting by employees of such matters to the AC or Lead Independent Director without fear of reprisal, discrimination or adverse consequences and also permits the Company to address such reports by taking appropriate action, including, but not limited to, disciplining or terminating the employment of those responsible. However, while the Whistleblowing Policy is meant to protect genuine whistleblowers from any unfair treatment as a result of their report, it strictly prohibits frivolous and bogus complaints.

Whistleblowers are encouraged to identify themselves when raising concerns or providing information. The Company shall maintain the confidentiality of the person making the report to the fullest extent reasonably practicable within the legitimate needs of law. Exceptional cases where disclosure of a whistleblower's identity or information provided may be required include, (i) the Company is under legal obligation to make such disclosure; (ii) the information is already in the public domain; (iii) information is provided in confidence to legal or auditing professionals for the purpose of obtaining professional advice; and (iv) the information is required by the authorities. Notwithstanding the above circumstances, every eff ort will be taken to maintain confidentiality to the fullest extent possible. If the whistleblower's identity is to be revealed under circumstances not covered by the above, discussion will be held with the whistle blower before any disclosure is made.

Concerns should be raised in writing. As it is essential for the Company to have all critical information in order to be able to eff ectively evaluate and investigate a complaint, the report made should provide as much detail and be as specific as possible. The complaint should include details of the parties involved, dates or period of time, the type of concern, evidence substantiating the complaint, where possible, and contact details, in case further information is required. All matters reported will be reviewed within a reasonable timeframe, and after due consideration and inquiry, a decision will be taken on whether to proceed with a detailed investigation.

Internal Audit

The Company has outsourced its internal audit function to BDO. The internal audits are performed in line with their firm's Global Internal Audit Methodology which is consistent with the International Standards for the Professional Practice of Internal Auditing recommended by the Institute of Internal Auditors. The internal audit was conducted with the objectives of highlighting missing controls of the current processes, ascertain that processes were conducted in accordance with established policies and procedures and to identify areas of improvement where controls can be strengthened. Internal control weaknesses noted during the audit and the respective auditors' recommendations are reported to the AC and follow-ups and implementations are handled by the Investment Manager where applicable.

The AC has reviewed with the internal auditors their risk-based internal audit plan and their evaluation of the system of internal controls, their audit findings and the management's responses to address the findings; assessed the adequacy and the eff ectiveness of material internal controls, including financial, operational, compliance and IT controls and overall risk management systems of the Company and the Group for FY2024; as well as ensured that the internal auditors have an appropriate standing within the Group to perform its function eff ectively. The outsourced internal audit team is headed by a partner who has more than 20 years of experience in audit and advisory services, and is a Chartered Accountant of the Institute of Singapore Chartered Accountants and Certified Internal Auditor of the Institute of Internal Auditors. The AC is satisfied that the outsourced internal audit function is independent, eff ective and adequately resourced.

Shareholder Rights and Conduct of General Meetings as well as Engagement with Shareholders and Stakeholders

Principle 11: The company treats all shareholders fairly and equitably in order to enable them to exercise shareholders' rights and have the opportunity to communicate their views on matters aff ecting the company. The company gives shareholders a balanced and understandable assessment of its performance, position and

prospects.

Principle 12: The company communicates regularly with its shareholders and facilitates the participation of shareholders during general meetings and other dialogues to allow shareholders to communicate their views on various matters aff ecting the company.

Principle 13: The Board adopts an inclusive approach by considering and balancing the needs and interests of material stakeholders, as part of its overall responsibility to ensure that the best interests of the company are served.

Shareholder Communications

The Company is committed to upholding Shareholders' rights through transparent and timely communication. In addition to complying with the disclosure requirements under the Listing Manual, the Company ensures the prompt and inclusive dissemination of material price- and trade-sensitive information. Financial results and material developments are announced in a timely manner, providing Shareholders with a clear assessment of the Company's performance and financial position at least on a half-yearly basis.

The Annual Reports, circulars, notices and agenda for general meetings are published on the SGX website (www.sgx.com) and made available on the Company's website (www.tih.com.sg) with adequate notice provided for such meetings. Notices and agendas are also advertised in major local newspapers for greater awareness. All announcements released on the SGX website are accessible on the Company's website. Press releases are issued as and when necessary to highlight significant developments, ensuring Shareholders remain well-informed.

Conduct of General Meetings

The Company prioritizes Shareholder engagement and participation in general meetings by holding them at convenient and accessible locations in Singapore. Shareholders who are unable to attend in person may appoint up to 2 proxies to attend and vote on their behalf, as permitted under the TIH's Constitution. For Shareholders who qualify as relevant intermediaries under Section 181 of the Companies Act 1967 of Singapore ("Companies Act"), more than 2 proxies may be appointed.

Subject to TIH's Constitution, the Companies Act and Listing Manual, the Directors may, at their sole discretion, approve and implement, subject to such security measures as may be deemed necessary or expedient, such voting methods to allow Shareholders who are unable to vote in person at any general meeting the option to vote in absentia, including but not limited to voting by mail, electronic mail or facsimile.

The Company addresses questions received in advance by releasing announcement(s) on the SGX website and making them available on the Company's website. A question-and-answer session is always included at all general meetings to allow questions, feedback and participation from Shareholders. Directors and the Company's external auditors, KPMG, are present at general meetings to address Shareholders' queries, particularly those related to the Company's business, audited financial statements, the conduct of the audit and the auditors' report. To ensure fair treatment to Shareholders who are not present at the meeting, the Board is reminded not to divulge any information that has not been publicly announced.

The Company tables separate resolutions at general meetings on each substantially separate issue and avoids "bundling" resolutions without valid reasons. All resolutions are put to the vote by electronic poll voting, with the polling agent explaining the poll voting procedures to the Shareholders/proxies/corporate representatives before voting commence. Independent scrutineers are appointed to verify votes tabulation. The voting results, including the number and percentage of votes cast for and against each resolution, are displayed immediately after each resolution, before the Chairman declares whether the resolution is passed. In addition, the voting results, the name of the independent scrutineers' firm, and any other requisite information are also announced on the SGX website later on the same day, following the conclusion of the general meeting.

The minutes of general meetings, including substantial and relevant Shareholder comments, queries from Shareholders relating to the agenda of the meeting, and responses from the Board and the Investment Manager, are prepared by the Company Secretary and published on the SGX website and the Company's website within 1 month of the general meetings.

Investor Relation Policy

The Company has in place an Investor Relations Policy which sets out the mechanism through which Shareholders and stakeholders may contact the Company with questions and through which the Company may respond to such questions. The Company is committed to maintaining high standards of disclosure and corporate transparency by providing consistent, relevant and timely information regarding the Company's business developments and performance in an open and non-discriminatory approach so as to assist Shareholders and investors in their investment decision-making. The Investment Manager has outsourced its investor relation function to Citigate Dewe Rogerson Singapore Pte. Ltd. (CDR), who has a team of personnel who focus on facilitating the Company's communications with all stakeholders including shareholders, regulators, analysts and media, etc. – on a regular basis, to attend to their queries or concerns as well as to keep the investors public apprised of the Company's corporate developments and financial performance.

Stakeholders Engagement

The Company's corporate website at www.tih.com.sg was launched in October 2014 to provide timely updates on the Company's news and developments. The website contains all announcements made by TIH and the corporate information and data of TIH. It also contains an online enquiry form where all stakeholders can direct their queries to. In addition, queries may also be sent directly to tih@cdrconsultancy.com. More stakeholders engagement arrangement and relationship management information is disclosed in the "Sustainability Report" section of this Annual Report.

Dividend Policy

The Company's Dividend Policy, subject to review from time to time, seeks to maximise Shareholders' value after taking into account the Company's cash position, retained earnings available for distribution, working capital requirements, capital commitments, future investment pipeline and any factors which may be deemed necessary by the Board.

Securities Dealings

The Company has in place policies on (i) dealings in securities of the Company and its subsidiaries; and (ii) dealings in securities of other listed entities in which the Company has investments ("Portfolio Companies"). These policies set out the requirements under the Securities and Futures Act 2001, Companies Act and the Listing Manual.

The policy on dealings in securities of the Company and its subsidiaries applies to Directors and officers of the Company and Directors and employees of its subsidiaries. There is also a policy on dealings in securities of Portfolio Companies, which applies to Directors and officers of the Company. Similar policies have been adopted by the Investment Manager in respect of the trading of securities of the Company and its Portfolio Companies by the Directors and officers of the Investment Manager. The Company Secretary sends out half-yearly reminders on these requirements to all Directors and employees.